Finance

Through SAP Business One, you can streamline your finance operations – from managing accounts payable and receivable to automating expense tracking and ensuring tax compliance.

Revolutionising finance

with unparalleled efficiency

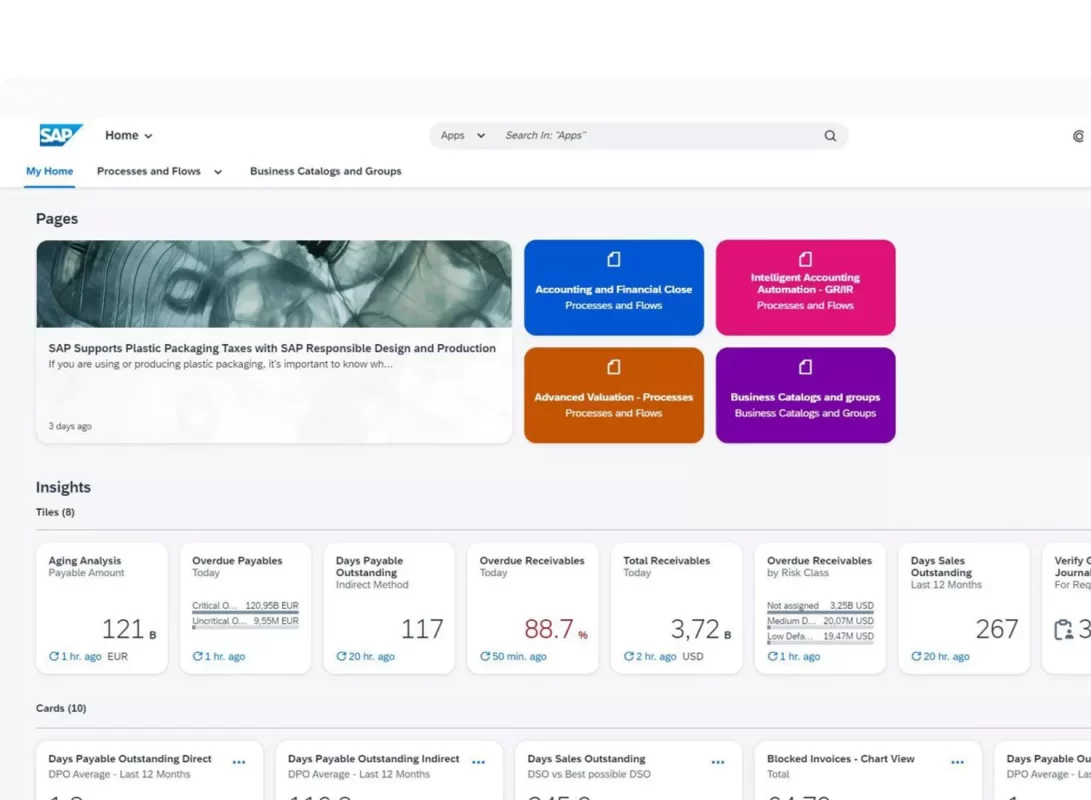

SAP Business One equips your finance team with a unified view of your company’s financial health. Its intelligent automation enhances forecasting accuracy, accelerates reporting, simplifies decision-making, and strengthens risk and compliance management.

Financial planning and analysis

Data-driven decisions that improve business performance

- Comprehensive Financial Planning Develop, manage, and oversee financial strategies across your organization using built-in tools and predictive models that drive informed decision-making.

- Financial Performance Tracking Access detailed reports on essential financial metrics, with the ability to drill down into transactional data for deeper analysis and performance evaluation.

- Data-Driven Decision Making Leverage real-time insights and advanced scenario simulations to make well-informed decisions and navigate financial challenges with confidence.

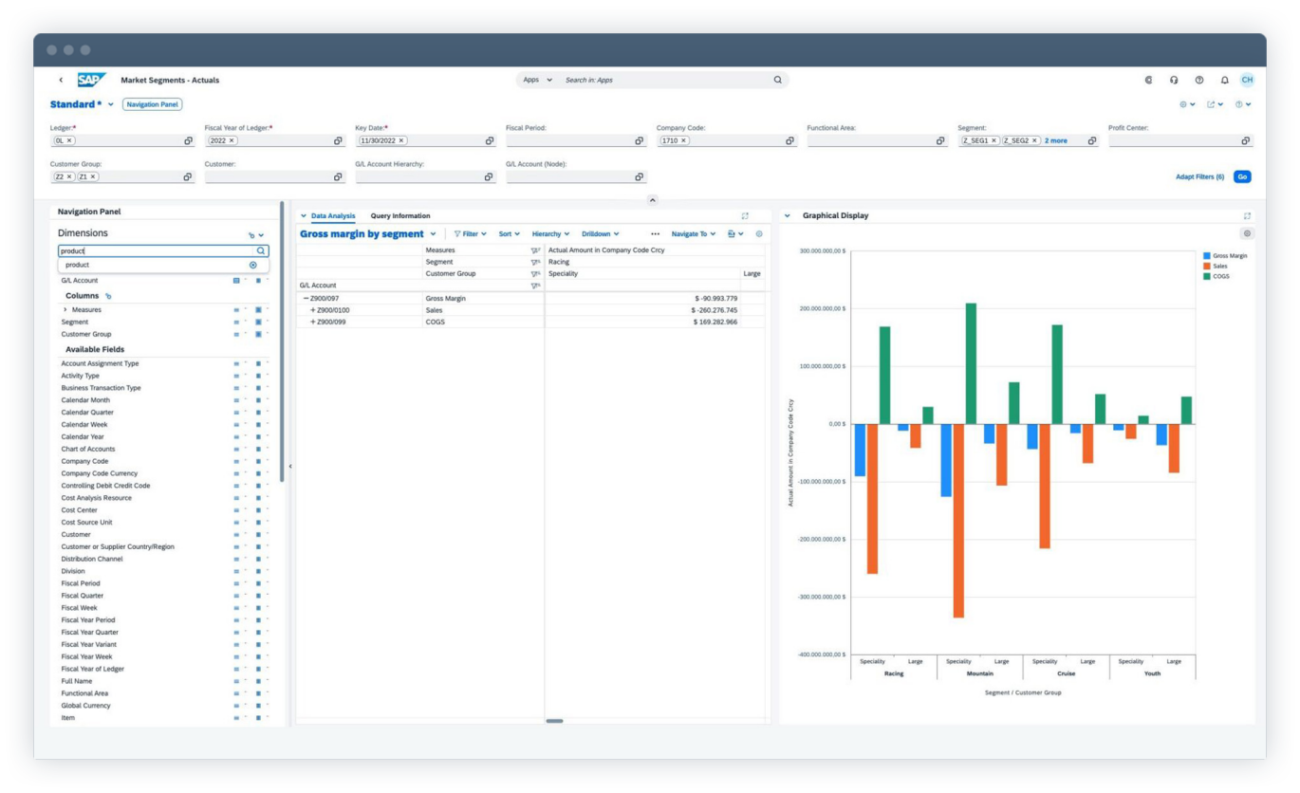

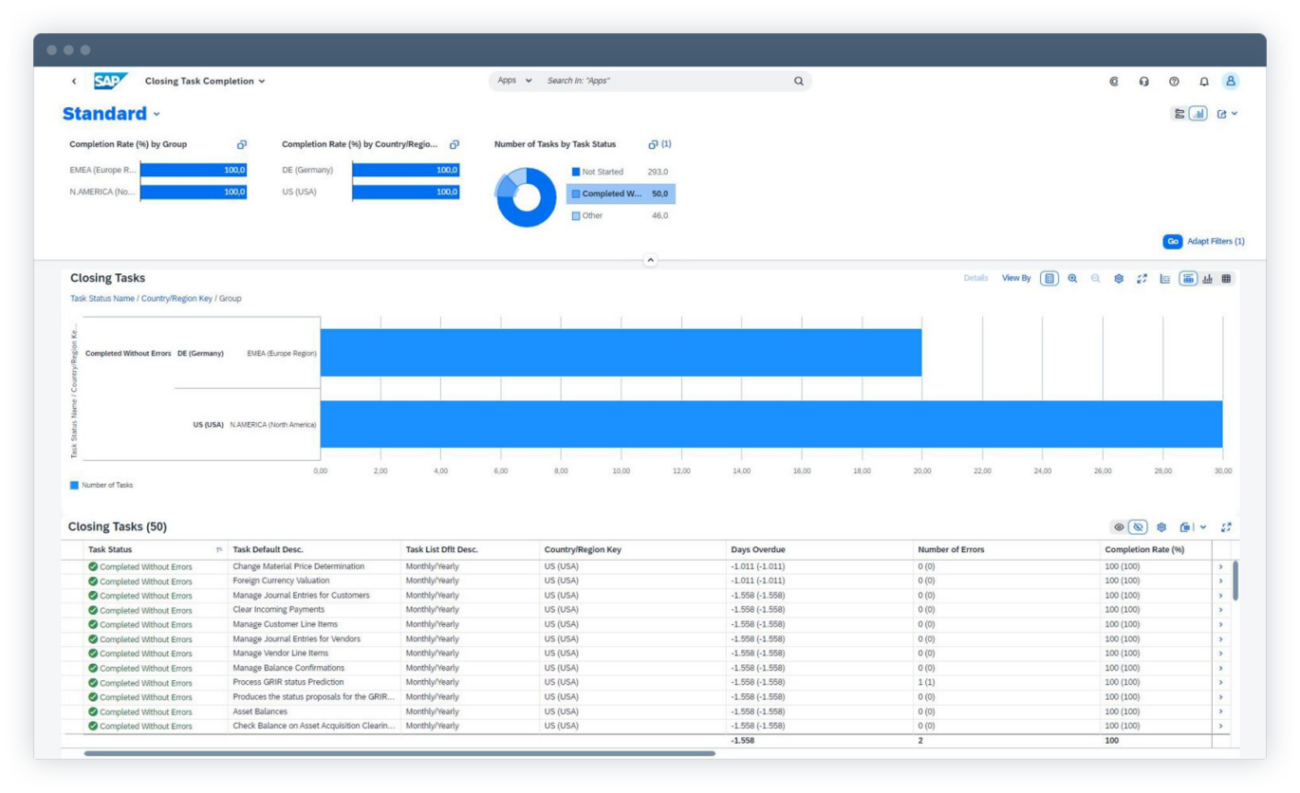

Accounting and financial close

Automation that streamlines accounting processes and improves accuracy

- Centralized Financial Data Management Unify financial data and processes in a single platform, supporting multiple accounting standards and real-time parallel ledger valuations for complete transparency.

- Streamlined Financial Transaction Recording Enhance accuracy and efficiency by automating postings, allocations, and workflows, along with proactive handling of financial situations.

- Integrated Entity and Group Closing Leverage real-time insights and automation to strengthen governance, improve compliance, and accelerate both entity and corporate closing processes.

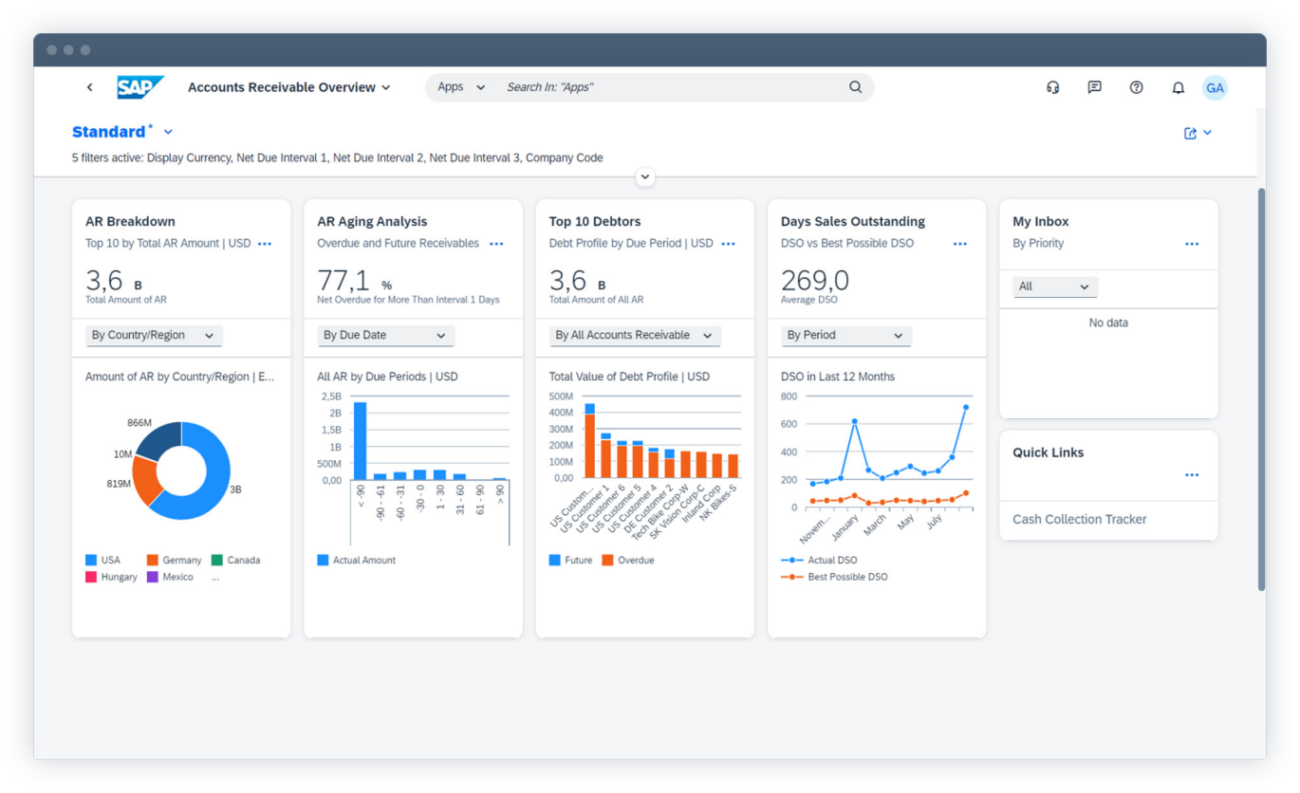

Finance operations

Efficient management of accounts payable and receivable

- Enhanced Accounts Receivables Management Accelerate the management of open receivables and dispute resolution while effectively controlling customer credit risk and minimizing bad debt.

- Streamlined Accounts Payable Processing Utilize automated accounts payable workflows to manage vendor payments more efficiently, ensuring better control over cash outflows.

- Improved Financial Health and Transparency Track receivables with advanced analytics, proactively resolve disputes, and identify root causes to maintain financial stability and transparency.

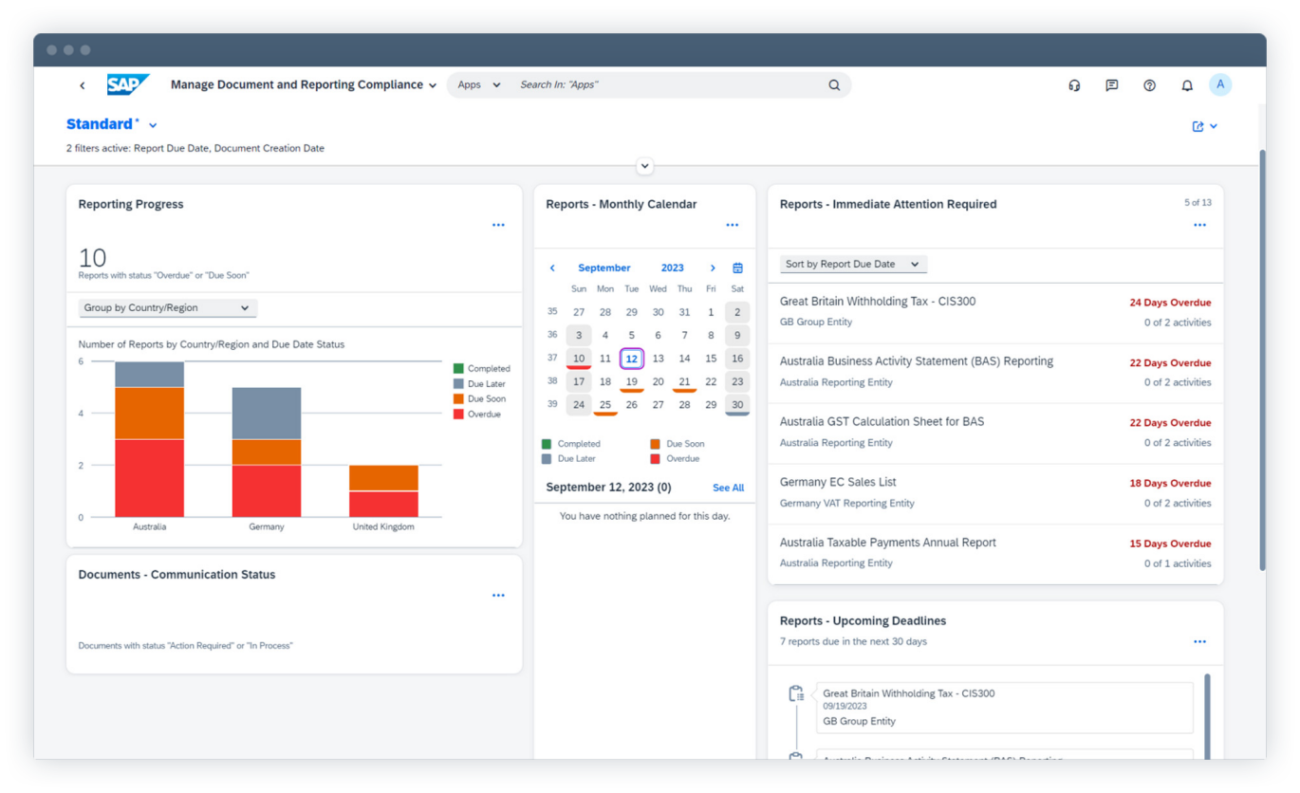

Compliance and tax management

Effective management of regulations through compliance, risk mitigation, and controls

- Immediate Insights into Compliance and Risk Receive real-time updates on compliance risks, reporting deadlines, and potential issues with global regulatory authorities to stay ahead of non-compliance.

- Automated Document Handling and Validation Automatically generate and exchange documents, manage corrections efficiently, and ensure consistency with regulatory portals through streamlined processes.

- Streamlined and Uniform Global Reporting Ensure data quality and address issues with complete traceability, in-depth transaction analysis, and electronic submission capabilities for standardized reporting worldwide.

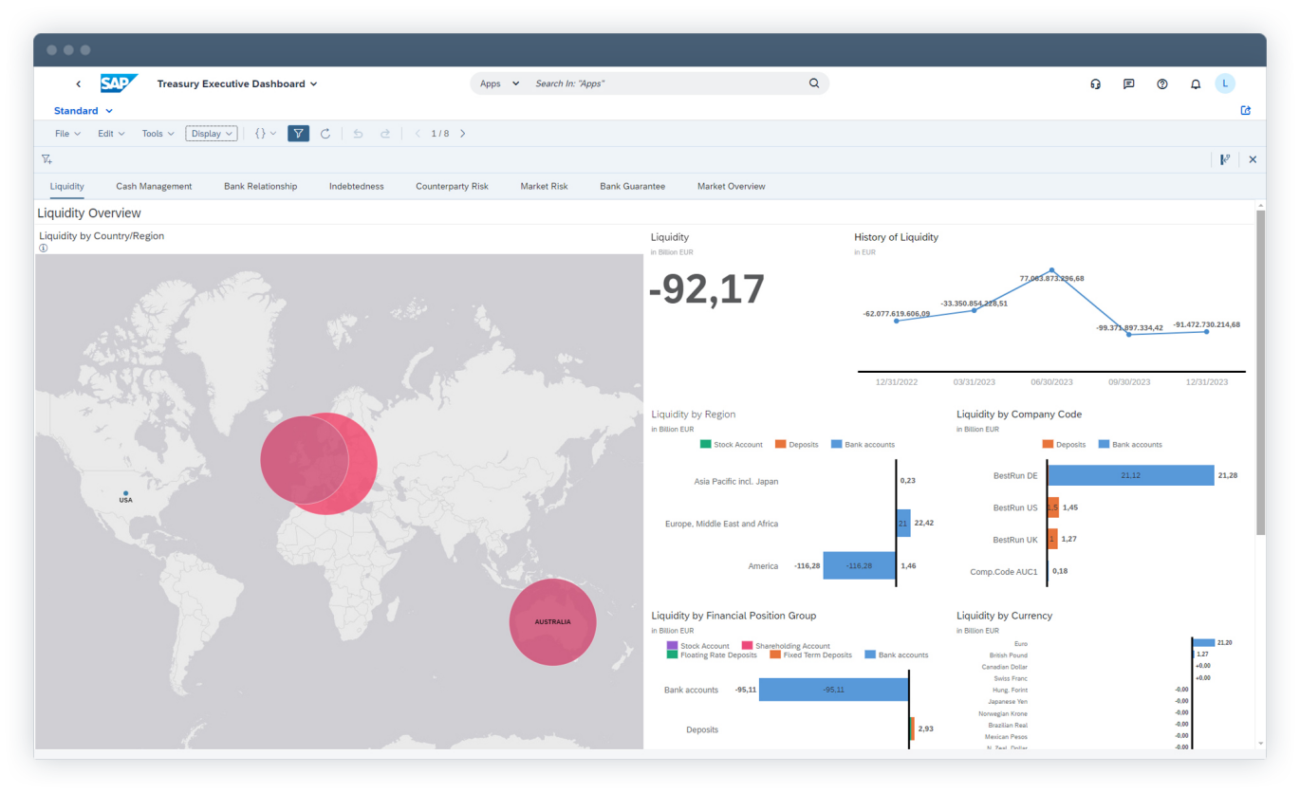

Treasury management

Optimised working capital and mitigation of financial risks

- Centralized Cash, Liquidity, and Working Capital Management Oversee the entire bank account lifecycle from a single point and track cash operations to enhance liquidity and optimize working capital.

- Simplified Payments and Bank Interactions Centralize and streamline both internal and external payments with automated processes and secure bank communications for greater efficiency.

- Effective Financial Risk Management Reduce financial risks through strategic investments and borrowing, while ensuring compliance with relevant regulations.

Rajlaxmi Solutions Pvt Ltd offers advanced SAP Finance Management solutions designed to streamline financial operations and enhance business efficiency. Our expertise in SAP integration helps businesses automate processes, improve accuracy, and gain real-time insights into financial data. With SAP’s robust features, we ensure seamless financial tracking, budgeting, and reporting, empowering organizations to make data-driven decisions and achieve sustainable growth.

Our SAP Finance Management services are tailored to meet the unique needs of your business, optimizing cash flow, improving financial compliance, and enhancing reporting capabilities. Whether you are looking to implement a new SAP system or enhance your existing financial processes, Rajlaxmi Solutions Pvt Ltd provides expert guidance every step of the way.

Partner with us to modernize your financial management with SAP, ensuring better decision-making, enhanced productivity, and overall business success. Let us help you navigate the complexities of finance management and unlock your company’s full potential. Reach out to Rajlaxmi Solutions Pvt Ltd today for customized SAP Finance Management solutions that drive results.

Tally Software

Tally Software

Customization

Customization

Tally Services

Tally Services

Tally Modules

Tally Modules

CRM

CRM

Contact and Lead Management

Contact and Lead Management

Sales Automation

Sales Automation

Pipeline Management

Pipeline Management

Reporting and Analytics

Reporting and Analytics

Contact center

Contact center

Marketing

Marketing

Tasks & Projects

Tasks & Projects

Tasks Assignment and tracking

Tasks Assignment and tracking

Project Planning and Management

Project Planning and Management

Gantt chart

Gantt chart

Time tracking

Time tracking

HR & Automation

HR & Automation

Employee Engagement Tools

Employee Engagement Tools

Workflow automation

Workflow automation

Worktime tracking & reports

Worktime tracking & reports

Absence management

Absence management

Announcements & appreciations

Announcements & appreciations

Requests & approvals

Requests & approvals

Collaboration

Collaboration

Project Colabration Tool

Project Colabration Tool

Document Sharing and Management

Document Sharing and Management

Online documents

Online documents

Drive

Drive

Webmail

Webmail

Copilot

Copilot

CoPilot in CRM

CoPilot in CRM

CoPilot in Tasks

CoPilot in Tasks

CoPilot in Chat

CoPilot in Chat

Mobile & SEO friendly

Mobile & SEO friendly

CoPilot in Feed

CoPilot in Feed

CoPilot in Sites & Stores

CoPilot in Sites & Stores

Financial management

Financial management

Accounting

Accounting

Controlling

Controlling

Fixed asset management

Fixed asset management

Banking and reconciliation

Banking and reconciliation

Financial reporting and analysis

Financial reporting and analysis

Manufacturing

Manufacturing

Production engineering

Production engineering

Production planning

Production planning

Quality management

Quality management

Manufacturing options

Manufacturing options

Manufacturing operations

Manufacturing operations

Sales and customer management

Sales and customer management

Customer order management

Customer order management

Billing and invoicing

Billing and invoicing

Customer returns

Customer returns

Price management

Price management

Sales rebate management

Sales rebate management

Supply chain

Supply chain

Inventory management

Inventory management

Order promising

Order promising

Asset management

Asset management

Technical asset management

Technical asset management

Demand monitoring

Demand monitoring

Maintenance execution

Maintenance execution

Planning, scheduling and dispatching

Planning, scheduling and dispatching

Reporting

Reporting

Accounting

Accounting

Accounting Masters

Accounting Masters

Payments

Payments

Tax Masters

Tax Masters

Share Management

Share Management

Banking

Banking

Manufacturing

Manufacturing

Production

Production

Bill of Materials

Bill of Materials

Reports

Reports

Tools

Tools

Assets

Assets

Maintenance

Maintenance

Asset Movement

Asset Movement

Asset Activity

Asset Activity

Asset Maintenance

Asset Maintenance

CRM

CRM

Sales Pipeline

Sales Pipeline

Masters

Masters

Reports

Reports

Campaign

Campaign

Website

Website

Blog

Blog

Web Site

Web Site

Support

Support

Issues

Issues

Maintenance

Maintenance

Warranty

Warranty